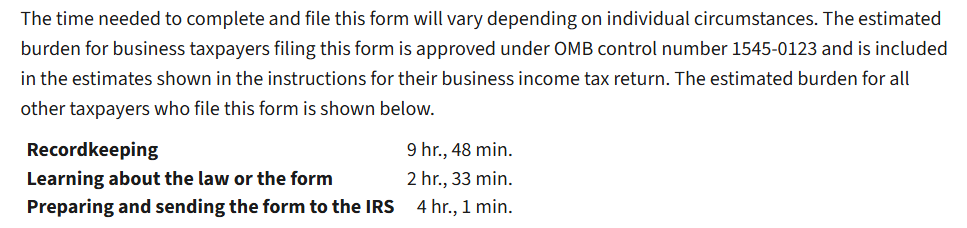

16+ Hours Needed To File With The IRS

According to the IRS, the time needed to complete and file form 2553 is estimated to be over 16 hours. With eBusinessDocs’ S-Corp Election, you’ll be done in just minutes. Our unique online application streamlines the process and ensures we get all of the information we need to file your form 2553 on your behalf. For more information on estimated time needed to complete and file as stated by the IRS you can visit this IRS link.

This is a screenshot directly from the IRS's website, from the Instructions for Form 2553 page.

Our Reviews

Easier with eBusinessDocs

Filing was much easier with ebusinessdocs compared to the IRS. The IRS document was complicated and the IRS says you need to dedicated 10’s of hours to filing through them. I’m so happy I came across eBusinessDocs! I got my confirmation letter too! Thank you!

– Stacy H., S-Corporation

10/10 Service

I had no idea I had to elect my S Corp by a certain date. A friend and a business vendor suggested I use eBusinessDocs. It was so easy and quick to file. I would definitely recommend eBusinessDocs, it’s a 10/10 service for how easy and fast it is.

– Jerry F., S-Corporation

Frequently Asked Questions

The IRS will process your application within about 60 days of filing. If you don’t hear from the IRS within that time window you can contact them directly to confirm that they are working on your application.

The IRS allows relief for late elections if you meet specific criteria and can show “reasonable cause,” often requiring a late-election statement on Form 2553.

You must file no more than 2 months and 15 days after your tax year begins—or any time during the prior tax year—to have the election effective for the upcoming year.

Eligible entities include domestic C‑Corporations (or LLCs taxed as corporations) with fewer than 100 U.S. shareholders, a single class of stock, and shareholder consent.

Form 2553 is the IRS form small businesses file to elect S‑Corporation tax status—enabling profits and losses to pass through to owners’ personal returns and avoiding double taxation. Please consult your tax professional to determine if an S-Corp election is right for you.

¹ The determination to permit or not permit and S Corp election is at the discretion of the IRS. eBusinessDocs cannot impact the IRS decision process. Our money back guarantee applies only to the accuracy and timeliness of the filing once we have been hired to do so. If your application is denied due to a filing error on our part, we will refund your eBusinessDocs application filing fee.